MUMBAI (Reuters) – Fortifying India’s macroeconomic fundamentals is the best shield against elevated global uncertainties, a deputy governor of the country’s central bank said in New York on Monday.

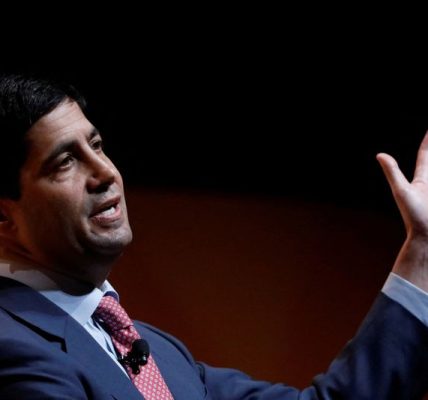

India’s merchandise exports and imports have been negatively impacted during episodes of rising geopolitical risk, deputy governor Michael Patra said in a speech at the New York Fed Central Banking Seminar, a copy of which was published by the Reserve Bank of India on Tuesday.

“We believe that the best defence against global risks is to strengthen the macroeconomic fundamentals and build adequate buffers, supported by prudent macroeconomic policies,” he said.

India’s central bank has been opportunistically building its foreign exchange reserves which now cover the external debt, all debt servicing requirements and are equivalent to or close to 12 months of imports, Patra said.

The central bank estimates India’s real GDP will expand 7.2% in fiscal year 2024/25 and around 7% in 2025/26.

“Thereafter, there is a strong likelihood that India’s growth will revert to the 8% trend,” Patra said.

Meanwhile, inflation rose above the central bank’s target of 4% in September after slipping below it during July and August.

The rise in inflation was due to a pickup in price momentum in some food items and adverse base effects inherent in year-on-year measurement, the deputy governor said.

“Our projection indicates that these price pressures will persist in October and November before headline inflation realigns with the target from December 2024 and remains aligned in 2025/26,” he added.

Uncertainty shocks lead to slower growth but higher inflation, the deputy governor said.

“This presents a dilemma for monetary policy: tighten to control high inflation or ease to respond to lower growth!”

The RBI has kept rates on hold for ten straight meetings and is expected to start lowering them, possibly in early 2025.